Well we are done to a month to the day.

The day that the options expire that our Mock Grain Marketing Character Neutral Nick has been using; it has been a long rather stressful ride for him in these volatile markets. Nick stil has a chance to make it huge; but he also has a chance to lose the farm in the finally few weeks if he doesn't do a good job managing his very much over leveraged position.

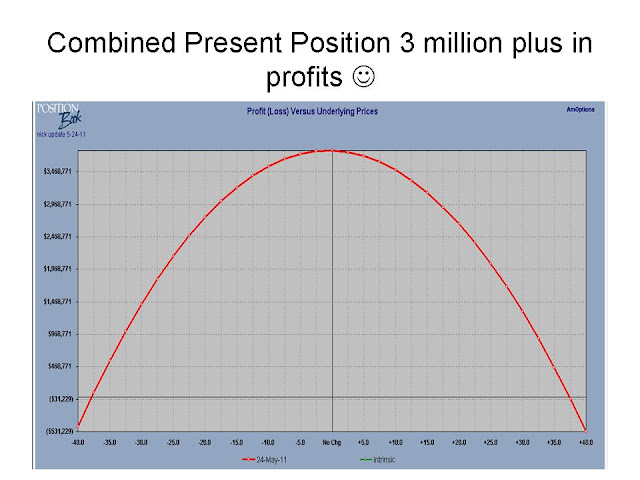

If you remember Nick decided to try a Delta Neutral Style of commoditiy hedging; in particular Nick had a goal of having delta bushels sold of 100,000 bushels each for corn, soybeans, and wheat. He has managed that but along the way he has seen million bushel plus swings; because he is so highly leverage in options plus Nick is always adjusting after the fact which by nature is usually wrong. I.E. when Nick sells puts he does it after the market has already went up; not before it goes up. Same thing for calls that he is selling; he is always selling them after the market has went down. So by nature Nick's system if you will is also losing gamma and going in the wrong direction. Nick has also been short options; and folks we have had some volitale markets so that also hasn't helped Nick along the way. The one option greek that Nick does have working for him is Theta or time value; that has been helping Neutral Nick out alot. So much so that presently his trades have him up over 3 million dollar and potentially as much as 30- 37 million dollars depending on how the markets shake out the next thirty days . His Theta broke down on a per day basis is close to $800,000

Keep in mind that Nick's system has many flaws and things don't have to go easy over the next 30 days; please look over various pages in this blog and you will see many errors or flaws in Nick's game plan. Plus keep in mind the risk that futures and options have; they simply don't work for everyone.

Below are his graphs after updating positions.

Once again he sold July options, in CBOT Wheat, Corn, and Soybeans. He only sold this time; purchased none and mainly used straddles and strangle combinations that where weighed to the side that moved delta bushels closer to 100,000 sold.

One flaw seen in his trading has been how it has exploded going from small lots to more then huge lots.

For Wheat Nick sold 250 of the 7.50 puts, 750 of the 8.00 calls, and 2,000 of the 8.50 calls thus getting his delta bushels back toward a short 103,000.

For Beans Nick sold 500 of the 14.00 July Soybean calls and 195 of the 13.40 July soybean puts.

For Corn Nick sold 1300 of the July 7.50 Corn calls and 100 of the July 7.00 Corn Puts.

The day that the options expire that our Mock Grain Marketing Character Neutral Nick has been using; it has been a long rather stressful ride for him in these volatile markets. Nick stil has a chance to make it huge; but he also has a chance to lose the farm in the finally few weeks if he doesn't do a good job managing his very much over leveraged position.

If you remember Nick decided to try a Delta Neutral Style of commoditiy hedging; in particular Nick had a goal of having delta bushels sold of 100,000 bushels each for corn, soybeans, and wheat. He has managed that but along the way he has seen million bushel plus swings; because he is so highly leverage in options plus Nick is always adjusting after the fact which by nature is usually wrong. I.E. when Nick sells puts he does it after the market has already went up; not before it goes up. Same thing for calls that he is selling; he is always selling them after the market has went down. So by nature Nick's system if you will is also losing gamma and going in the wrong direction. Nick has also been short options; and folks we have had some volitale markets so that also hasn't helped Nick along the way. The one option greek that Nick does have working for him is Theta or time value; that has been helping Neutral Nick out alot. So much so that presently his trades have him up over 3 million dollar and potentially as much as 30- 37 million dollars depending on how the markets shake out the next thirty days . His Theta broke down on a per day basis is close to $800,000

Keep in mind that Nick's system has many flaws and things don't have to go easy over the next 30 days; please look over various pages in this blog and you will see many errors or flaws in Nick's game plan. Plus keep in mind the risk that futures and options have; they simply don't work for everyone.

Below are his graphs after updating positions.

Once again he sold July options, in CBOT Wheat, Corn, and Soybeans. He only sold this time; purchased none and mainly used straddles and strangle combinations that where weighed to the side that moved delta bushels closer to 100,000 sold.

One flaw seen in his trading has been how it has exploded going from small lots to more then huge lots.

For Wheat Nick sold 250 of the 7.50 puts, 750 of the 8.00 calls, and 2,000 of the 8.50 calls thus getting his delta bushels back toward a short 103,000.

For Beans Nick sold 500 of the 14.00 July Soybean calls and 195 of the 13.40 July soybean puts.

For Corn Nick sold 1300 of the July 7.50 Corn calls and 100 of the July 7.00 Corn Puts.

No comments:

Post a Comment