Below are the mock trades placed this week at during our weekly MWC Marketing Hour Round Table; which was held today Wed at 3:30 (this and every week at that time).

During this session we listened to Country Hedgings update on the USDA Report (it can be found at http://www.countryhedging.com/ )

We then went threw some other info on today's report, then went on to our charts and technical analysis of the recent price action, and finally we followed up last weeks trades and added a new trade this week. One thing that has been noted is that perhaps more follow up or changes would have been done to the trades if we had been updating on a daily basis; such as moving stops up on profitable trades; whereas the way it was done we actually seen profitable trades turn into losers a couple of times. But that is part of what we are trying to do; learn some of the good things and bad things from various methods of trading/hedging/grain marketing.

This week you see we have some more unique trades and a couple of them are multi leg and honestly hard to evaluate because they entail more then 1 option. There are also a couple of simple buy at X, risk to X, with an objective of X, and then a trade that is like a risk and reverse trade.

See below for the trades and results of previous trades. Kevin did have a good one that earned him the nickname Kevin the Great as he had one MPLS trade that returned him 63 cents profit, and Dan the Man has managed to lock in a couple of winning trades, while myself and Jordan struggled on a couple of trades thus focused on some option trades.

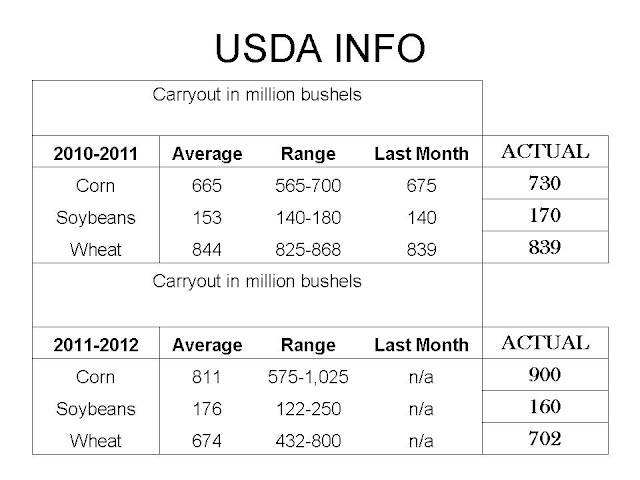

Below the trades you will see some info on the USDA Report; the charts are skewed as they show year over year and then month by month.

During this session we listened to Country Hedgings update on the USDA Report (it can be found at http://www.countryhedging.com/ )

We then went threw some other info on today's report, then went on to our charts and technical analysis of the recent price action, and finally we followed up last weeks trades and added a new trade this week. One thing that has been noted is that perhaps more follow up or changes would have been done to the trades if we had been updating on a daily basis; such as moving stops up on profitable trades; whereas the way it was done we actually seen profitable trades turn into losers a couple of times. But that is part of what we are trying to do; learn some of the good things and bad things from various methods of trading/hedging/grain marketing.

This week you see we have some more unique trades and a couple of them are multi leg and honestly hard to evaluate because they entail more then 1 option. There are also a couple of simple buy at X, risk to X, with an objective of X, and then a trade that is like a risk and reverse trade.

See below for the trades and results of previous trades. Kevin did have a good one that earned him the nickname Kevin the Great as he had one MPLS trade that returned him 63 cents profit, and Dan the Man has managed to lock in a couple of winning trades, while myself and Jordan struggled on a couple of trades thus focused on some option trades.

Below the trades you will see some info on the USDA Report; the charts are skewed as they show year over year and then month by month.

| US Carryout Numbers | World Carryout Numbers | |||||||

| Corn | Beans | Wheat | Corn | Beans | Wheat | |||

| ’00 | 1.899 | 0.876 | ’00 | 6 | 1 | 7.5 | ||

| ’01 | 1.574 | 0.687 | ’01 | 5.8 | 1.2 | 7.4 | ||

| ’02 | 1.087 | 0.178 | 0.491 | ’02 | 4.8 | 1.5 | 6.1 | |

| ’03 | 0.958 | 0.112 | 0.547 | ’03 | 3.6 | 1.2 | 4.8 | |

| ’04 | 2.113 | 0.256 | 0.54 | ’04 | 5.1 | 1.8 | 5.6 | |

| ’05 | 1.967 | 0.449 | 0.571 | ’05 | 4.9 | 1.9 | 5.4 | |

| ’06 | 1.304 | 0.574 | 0.456 | ’06 | 4.3 | 2.3 | 4.7 | |

| ’07 | 1.624 | 0.205 | 0.306 | ’07 | 5.1 | 1.9 | 4.4 | |

| ’08 | 1.673 | 0.138 | 0.657 | ’08 | 5.7 | 1.5 | 6.1 | |

| ’09 | 1.708 | 0.151 | 0.976 | ’09 | 5.7 | 2.2 | 7.3 | |

| 10-May | 1.818 | 0.365 | 0.997 | 10-May | 6.071 | 2.428 | 7.279 | |

| 10-Jun | 1.573 | 0.36 | 0.991 | 10-Jun | 5.8 | 2.461 | 7.126 | |

| 10-Jul | 1.373 | 0.36 | 1.093 | 10-Jul | 5.554 | 2.49 | 6.872 | |

| 10-Aug | 1.312 | 0.36 | 0.952 | 10-Aug | 5.48 | 2.378 | 6.421 | |

| 10-Sep | 1.116 | 0.35 | 0.902 | 10-Sep | 5.337 | 2.337 | 6.534 | |

| 10-Oct | 0.902 | 0.265 | 0.853 | 10-Oct | 5.211 | 2.257 | 6.418 | |

| 10-Nov | 0.827 | 0.185 | 0.848 | 10-Nov | 5.085 | 2.256 | 6.339 | |

| 10-Dec | 0.832 | 0.165 | 0.858 | 10-Dec | 5.118 | 2.209 | 6.493 | |

| 11-Jan | 0.745 | 0.14 | 0.818 | 11-Jan | 5 | 2.141 | 6.54 | |

| 11-Feb | 0.675 | 0.14 | 0.818 | 11-Feb | 4.823 | 2.138 | 6.531 | |

| 11-Mar | 0.675 | 0.14 | 0.843 | 11-Mar | 4.848 | 2.143 | 6.684 | |

| April | 0.675 | 0.14 | 0.839 | April | 4.82 | 2.239 | 6.717 | |

| May | 0.675 | 0.14 | 0.839 | May | 4.8 | 2.3 | 6.7 | |

| 2012 | 0.9 | 0.16 | 0.702 | 2012 | 5.084 | 2.3 | 6.66 | |

No comments:

Post a Comment