Today we had another session of MWC Marketing Hour Round Table; during these meetings we go over various strategies related to grain markets/marketing, we cover the theories behind various strategies, the technical side of our grain markets as well as the charts that go with our markets, and we have some mock trading in which we place trades every week and keep track of those trade results.

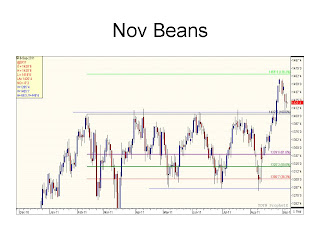

Below are some of the charts we covered in this afternoon's session

Jordan has a long 14.00 bean call against a 16.00 bean put on one trade; presently up rather good on this trade.

Today he purchased a 7.50 corn put (2 of them) and purchased a 15.00 bean call.

He then added a spread trade via buying oats and selling corn.

Dan had a couple future trades as he went long Dec corn at with a nickel rick and an objective of 15 cents profit. His other trade was short KC March with a 15 cent risk and an objective of about 40 cents profit.

Dan still owns the 13-13.80-14.60 Nov bean butterfly in that he is long a 13 call short 2 of the 13.80's and long 1 of the 14.60 calls.

Kevin Went long Nov Beans and short 2 contracts of Dec corn. Kevin also had a ratio spread trade open and during the last week it hit his follow up point.

He is long a 7.00 call versus 2 short 7.60 Dec call for about an 8 cent credit. He then rolled the 2 7.60 calls out to 4 of the 8.20 Dec Calls and also managed to do this for a credit.

Myself I added a couple of option trades via buying a 7.00 July 2012 corn call against 3 short 8.50 corn calls collecting a net of about $2100 or so. Thus having upside room and downside potential to make some money; but VOL isn't exactly my friend; so my ratio spread will be tough to manage.

The other trade I placed was hedge type of trade via shorting 1 of the Dec 2012 6.50 corn calls and buying 6 of the 7-6.50 Nov 2011 corn bear put spreads. A bear market bet that will return good if we have a hard breakdown; while if I look at it in a producers eyes it could be similar to a ending up in a HTA contract in 12 while getting nearby price protection.

I do have one open trade out there where I have the 7.20 Dec calls and puts purchased against the sale of 3 each of the 6.50 puts and 8.00 calls.

Below are some of the charts we covered in this afternoon's session

After we went threw the charts we talked about rolling a covered call.

We used the example of rolling a Dec 7.00 Call sold back in March when the market was trading in the low to mid 6.00 range for around 50 cents. We figured that today we could buy a Dec 7.00 call for about 75 cents thus locking in a 25 cent loss; but we could now sell our corn for about 7.50 on the board (7.25 net); which was about the best case we could do when we sold the call for the 50 cents to start with.

While what if we don't want to have corn sold anymore at 7.00; after all the price is going up? Isn't it? Well what happens if we sell a July 8.00 Call for about 80 cents. Answer we collect a nickel or so via rolling the short option out and we now have a top limited to 8.00 on the July Futures

Here is the Math on the trades

March Price when placed 6.30

Sold 7.00 call for 50 cents; purchased back for 75 cents; loss of 25 cents

Sold 8.00 July call for about 80 cents; now net we have collected 55 cents and raise our ceiling to 1.70 higher then the board when we opened this trade to start with.

.50 collected minus .75 bought back plus .80 collected = 80 cents that we can add to our price when we end up selling the product; in exchange for that 8.00 on the July futures appears to be the max we can get unless we use another strategy similar to this.

Last but not least this week we did some mock trades

Here are the open mock trades we have after today's session.

Today he purchased a 7.50 corn put (2 of them) and purchased a 15.00 bean call.

He then added a spread trade via buying oats and selling corn.

Dan had a couple future trades as he went long Dec corn at with a nickel rick and an objective of 15 cents profit. His other trade was short KC March with a 15 cent risk and an objective of about 40 cents profit.

Dan still owns the 13-13.80-14.60 Nov bean butterfly in that he is long a 13 call short 2 of the 13.80's and long 1 of the 14.60 calls.

Kevin Went long Nov Beans and short 2 contracts of Dec corn. Kevin also had a ratio spread trade open and during the last week it hit his follow up point.

He is long a 7.00 call versus 2 short 7.60 Dec call for about an 8 cent credit. He then rolled the 2 7.60 calls out to 4 of the 8.20 Dec Calls and also managed to do this for a credit.

Myself I added a couple of option trades via buying a 7.00 July 2012 corn call against 3 short 8.50 corn calls collecting a net of about $2100 or so. Thus having upside room and downside potential to make some money; but VOL isn't exactly my friend; so my ratio spread will be tough to manage.

The other trade I placed was hedge type of trade via shorting 1 of the Dec 2012 6.50 corn calls and buying 6 of the 7-6.50 Nov 2011 corn bear put spreads. A bear market bet that will return good if we have a hard breakdown; while if I look at it in a producers eyes it could be similar to a ending up in a HTA contract in 12 while getting nearby price protection.

I do have one open trade out there where I have the 7.20 Dec calls and puts purchased against the sale of 3 each of the 6.50 puts and 8.00 calls.

No comments:

Post a Comment